🔍 AI Landscape Weekly: August 19, 2025

🎯 Big Picture Enterprise Summary

The enterprise AI battleground has shifted dramatically with GPT-5's launch targeting Anthropic's coding dominance, while contact center vendors rush to differentiate real AI agent studios from rebranded chatbots. OpenAI's enterprise push challenges Anthropic's 32% market share through aggressive pricing and performance gains, as traditional platform vendors (NICE, Genesys, Five9) face increasing pressure to prove their "agentic AI" capabilities beyond marketing claims.

🏢 Vendor Platform Intelligence

OpenAI's Enterprise Counterattack

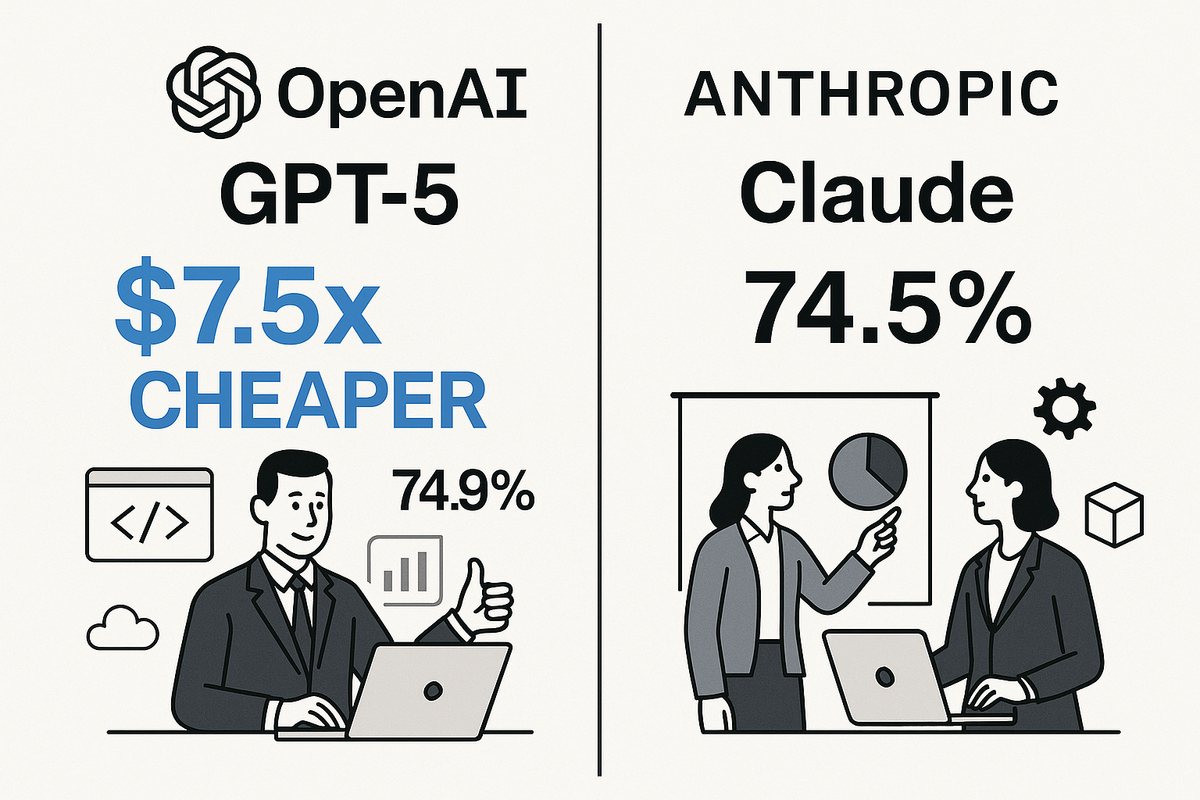

GPT-5 scores 74.9% on SWE-bench Verified coding tasks, just outperforming Anthropic's latest Claude Opus 4.1 model at 74.5%, marking OpenAI's direct challenge to Anthropic's coding supremacy.

Enterprise Translation:

- Best For: Organizations seeking cost-effective coding capabilities with enterprise-grade performance

- Cost Impact: GPT-5 is "significantly cheaper than Anthropic's top-end Claude Opus 4.1 — by a factor of seven and a half, in some cases"

- Risk Factors: OpenAI's infrastructure spending to maintain pricing edge may affect long-term stability

- Adoption Timeline: Since debut, "GPT-5 has more than doubled coding and agent-building activity and driven an eight-fold jump in reasoning workloads"

Key Technical Breakthrough: Cursor's co-founder described GPT-5 as "the smartest coding model we've ever tried," with the platform now defaulting new users to OpenAI - a significant enterprise adoption signal.

Anthropic's Strategic Response

Claude Sonnet 4 now offers a 1 million token context window, handling "requests as long as 750,000 words, more than the entire 'Lord of the Rings' trilogy, or 75,000 lines of code" - roughly five times Claude's previous limit.

Enterprise Translation:

- Best For: Complex enterprise codebases requiring extensive context analysis

- Cost Impact: Premium pricing for large context - "$6 per million input tokens and $22.50 per million output tokens" for prompts over 200,000 tokens

- Risk Factors: Anthropic "revoked OpenAI's access to its Claude family of AI models" showing increasing competitive tensions

- Adoption Timeline: Available now through Amazon Bedrock and Google Cloud Vertex AI

Market Reality Check: Anthropic holds "32% of the enterprise large language model market share by usage" versus OpenAI's 25%, but GPT-5's aggressive pricing threatens this lead.

Contact Center Platform Wars Intensify

NICE, Genesys, and Five9 have "recently launched AI studios, supporting brands in building AI agents that interact with customers", but differentiation is becoming critical.

NICE's Agentic Push: NICE announced "CXone Mpower Agents" claiming businesses can "build and deploy their first Mpower Agents 'in seconds'" with cross-system collaboration capabilities.

Genesys Revenue Surge: Strong performance driven by "Genesys Cloud AI" with "average number of unique agents for each of the top 50 Genesys Cloud customers increased to nearly 11,500 during the second quarter, a more than 25% increase year-over-year".

Five9's Strategic Shifts: CEO Mike Burkland announced retirement as company reported "second quarter revenue of $283.3 million, up 12% from a year ago" amid leadership transitions.

Enterprise Budget Reality: ServiceNow and Salesforce invested "$1.5 billion in Genesys" showing major enterprise platform vendors betting on contact center AI integration.

🔄 Foundation Model Integration Spotlight

The Federal Government Validation

The U.S. government "added Google, OpenAI, and Anthropic to a list of approved vendors that can offer artificial intelligence services to civilian federal agencies" through the Multiple Award Schedule (MAS) platform.

Enterprise Implication: Federal approval provides validation for enterprise procurement teams evaluating these vendors for large-scale deployments.

Microsoft's Multi-Vendor Strategy

Microsoft announced "Anthropic's Claude Code will be available as part of Microsoft's newly unveiled GitHub Copilot autonomous coding agent, in addition to OpenAI's Codex agent" - showing platform diversification beyond OpenAI partnership.

Strategic Shift: Microsoft "reportedly develops LLM series that can rival OpenAI, Anthropic models" with internal "MAI" series indicating reduced vendor dependency.

Enterprise Spending Acceleration

LLM budgets show "37% of respondents are now using 5 or more models as opposed to 29% last year" with clear specialization emerging: "Anthropic is a bit better at writing tasks—language fluency, content generation, brainstorming—while OpenAI models are better for more complex question-answering".

💡 Key Enterprise Term Definition: Agent Studio vs. Real Agentic AI

Agent Studio Marketing: Rebranded chatbot builders with visual interfaces Real Agentic AI: Multi-step reasoning systems that can orchestrate complex workflows across enterprise systems

Contact Center Reality Check:

- Agent Studios: Five9, Genesys, NICE offer visual agent builders

- True Agentic AI: "There's a big difference between developing a studio for autonomous AI and renaming pre-existing AI tools while expecting people to think it's a breakthrough"

- Enterprise Evaluation: Look for cross-system integration, multi-step reasoning, and workflow orchestration beyond simple question-answering

📈 Week's Key Enterprise Insight: The Performance Premium Battle

The Shift: Enterprise AI competition has moved from capability parity to price-performance optimization. GPT-5's aggressive pricing strategy - "seven and a half" times cheaper than Claude Opus 4.1 - represents a fundamental market shift where performance leaders must justify premium pricing.

Three Enterprise Strategies Emerging:

- Cost-Optimized Multi-Model: Use GPT-5 for volume tasks, Claude for specialized coding, Gemini for cost-sensitive workloads

- Premium Performance: Pay for Claude's extended context and specialized capabilities where ROI justifies costs

- Platform Lock-In: Leverage Microsoft's multi-vendor approach through GitHub Copilot and Azure AI Foundry

Strategic Reality: Anthropic reached "$2 billion in annualized revenue" while OpenAI hits "$12 billion per year revenue run rate" - showing that both premium and volume strategies can succeed simultaneously.

👀 What Enterprises Should Watch This Week

Contact Center Vendor Differentiation

Monitor which vendors deliver actual agentic capabilities versus enhanced chatbots. "The most compelling studios are like those old-school workbenches where every tool had a spot" with clear governance frameworks.

Coding Platform Shifts

Cursor "steering new users to OpenAI" while "existing Cursor customers will continue using Anthropic as their default model" indicates how quickly enterprise tool preferences can shift based on price-performance.

Enterprise Procurement Simplification

Federal MAS approval creates standardized procurement pathways that enterprise buyers can leverage for faster vendor evaluation and contracting.

Critical Success Factors to Monitor:

- Real-world performance vs. benchmark claims in enterprise deployments

- Total cost of ownership including context window pricing and infrastructure costs

- Vendor ecosystem stability as competitive pressures intensify

The enterprise AI landscape is experiencing its most significant price-performance disruption since ChatGPT's launch. Winners will be determined not by the most advanced AI capabilities, but by sustainable unit economics that deliver measurable business value at enterprise scale.

The bottom line: OpenAI's aggressive enterprise push with GPT-5 pricing challenges Anthropic's market position, while contact center vendors race to differentiate real agentic capabilities from rebranded legacy tools.

Sources

[1] Enterprises prefer Anthropic's AI models over anyone else's, including OpenAI's, TechCrunch, July 31, 2025

[2] OpenAI's GPT-5 is here, TechCrunch, August 7, 2025

[3] Anthropic's Claude AI model can now handle longer prompts, TechCrunch, August 12, 2025

[4] GPT-5's rollout fell flat for consumers, but the AI model is gaining where it matters most, CNBC, August 14, 2025

[5] NICE, Genesys, & Five9 Have All Released AI Agent Studios, CX Today, July 17, 2025

[6] ServiceNow, Salesforce invest $1.5 billion in Genesys as Five9 CEO retires, Constellation Research, August 1, 2025

[7] US adds OpenAI, Google, and Anthropic to list of approved AI vendors for federal agencies, TechCrunch, August 5, 2025

[8] Microsoft expands AI roster with Anthropic and xAI integrations, GeekWire, May 20, 2025

[9] How 100 Enterprise CIOs Are Building and Buying Gen AI in 2025, Andreessen Horowitz, June 19, 2025

[10] Foundation Models Soar Even as the Economy Unravels, Newcomer, April 16, 2025