Enterprise AI Intelligence Weekly: Multi-Agent Revolution Accelerates Platform Wars

Multi-Agent vs. Single Agent: Why This Matters

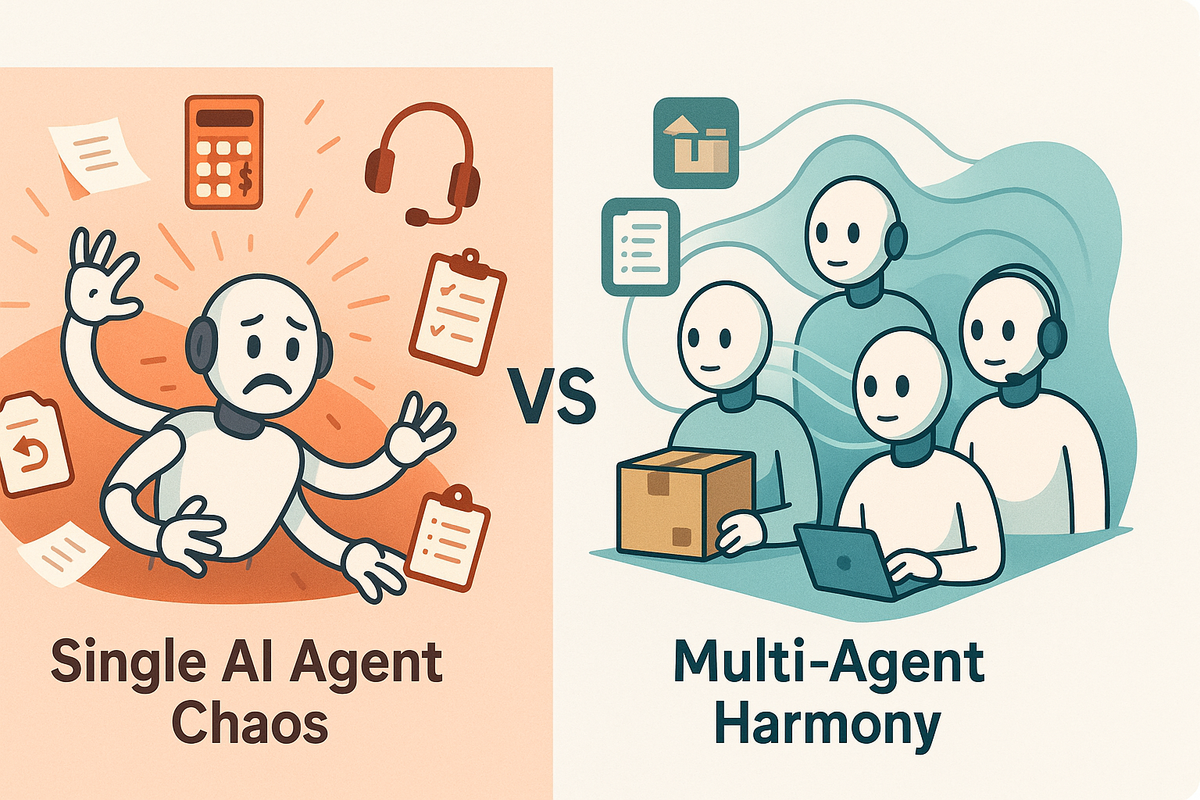

Single AI Agent Scenario: A customer calls saying "I was charged twice for my order, and I want to return one item."

Traditional AI: One agent tries to handle billing, inventory, shipping, and customer service - often gets confused or provides generic responses because it's trying to be expert at everything.

Multi-Agent Orchestration: The same customer call triggers:

- Billing Agent: Identifies the duplicate charge and processes refund

- Inventory Agent: Checks return policy and generates return label

- Customer Service Agent: Coordinates the response and follows up

Result: Each specialist agent handles what it does best, then shares information to solve the complete problem - just like a human customer service team would collaborate.

Why This Matters for Enterprises: Multi-agent systems can handle complex business processes that require multiple areas of expertise, while single agents excel at focused, repetitive tasks.

🎯 Big Picture Enterprise Summary: The enterprise AI vendor landscape is undergoing its most significant transformation since the ChatGPT launch, with multi-agent orchestration emerging as the new battleground. Microsoft leads with comprehensive multi-agent capabilities, while contact center vendors (NICE, Genesys, Five9) rush to deploy AI agent studios. The shift from single AI tools to orchestrated agent teams is forcing enterprises to rethink their entire AI platform strategy.

🏢 Vendor Platform Intelligence

Microsoft's Multi-Agent Dominance Play

Microsoft has unveiled the most comprehensive multi-agent strategy in enterprise AI, with Copilot Studio now supporting multi-agent orchestration across Microsoft 365, Azure AI, and Microsoft Fabric platforms. The real breakthrough: agents can now delegate tasks and share results to complete complex workflows, with support for the open Agent2Agent (A2A) protocol allowing connection to third-party platforms.

Enterprise Translation:

- Best For: Large enterprises already invested in Microsoft ecosystem

- Cost Impact: Leverages existing Microsoft investments rather than requiring new vendor relationships

- Risk Factors: Potential for deeper Microsoft lock-in as multi-agent workflows become critical

- Adoption Timeline: Generally available Q3 2025, with early access already rolling out

Key Technical Breakthrough: Computer use capability now allows Copilot Studio agents to perform tasks across desktop and web applications, automating repetitive processes through AI-powered UI interactions - essentially creating AI workers that can operate any software interface.

Contact Center Platform Wars Intensify

NICE, Genesys, and Five9 have all recently launched AI agent studios, supporting brands in building AI agents that interact with customers. However, the differentiation is becoming critical for enterprise buyers.

Five9's Integration Strategy: Five9 Fusion for Salesforce creates a fully integrated, AI-elevated solution combining Five9's real-time system of action with Salesforce's #1 AI CRM. With over 1,000 shared customers and 160,000+ service representatives already supported, this represents the deepest CRM-CCaaS integration in the market.

NICE's Differentiation Play: NICE's approach focuses on agents that can collaborate with systems beyond contact centers, scraping context from other enterprise solutions and triggering actions to automate complex queries. As NICE's Barry Cooper notes: "There's a big difference between AI that talks and AI that gets things done."

Market Reality Check: The 2025 Contact Center as a Service market analysis shows NICE, Genesys, Amazon Connect, and Five9 leading global rankings by both seats and revenue, but AI agent capabilities are rapidly reshuffling competitive positioning.

Enterprise Budget Reality: AI Moves from Experimental to Essential

Innovation budgets for LLM spending have dropped from 25% last year to just 7% in 2025, as enterprises increasingly pay for AI via centralized IT and business unit budgets. This signals AI's transition from experimental technology to essential business infrastructure.

Multi-Model Strategy Becomes Standard: 37% of enterprises now use 5 or more models compared to 29% last year, with model differentiation by use case being the main reason enterprises buy from multiple vendors. Enterprise buyers are discovering that "Anthropic is a bit better at writing tasks—language fluency, content generation, brainstorming—while OpenAI models are better for more complex question-answering".

🔄 Foundation Model Integration Spotlight

The Enterprise Vendor Packaging Wars

AI is trading its one-size-fits-all approach for hyper-specialized solutions tailored to industry challenges, with enterprise platforms becoming the primary delivery mechanism.

Dell-NVIDIA Enterprise AI Factory: Dell Technologies announces innovations across the Dell AI Factory with NVIDIA, including robust AI infrastructure and solutions that streamline the path to full-scale implementation. The enterprise positioning: organizations can seamlessly deploy agentic AI applications with NVIDIA AI Enterprise software platform, available directly from Dell.

Platform vs. Direct API Strategies: Gartner notes that in 2025 and beyond, many companies will turn to off-the-shelf AI solutions for predictability and ease, with the tradeoff being less flexibility and potential vendor lock-in. However, it's clearly easier to adopt AI through application vendors than trying to build your own platform given that the market for enterprise platform tools is still very fragmented.

The Model Performance Reality Check

67% of OpenAI users have deployed non-frontier models in production, compared to just 41% for Google and 27% for Anthropic, indicating that enterprises value model ecosystem breadth over just cutting-edge capabilities.

Google's Enterprise Comeback: Google's rise has been more pronounced within large enterprises, as they frequently have existing relationships with GCP and can tap into the brand trust of a mega-cap company. The performance of Gemini 2.5 vaulted them into true frontier model status, making Google a credible enterprise alternative.

💡 Key Enterprise Term Definition: Multi-Agent Orchestration

Traditional AI Approach: Single AI model handles one task at a time Multi-Agent Orchestration: Multiple specialized AI agents work together, delegating tasks and sharing results to complete complex workflows

Vendor vs. Direct Implementation:

- Vendor Platforms: Microsoft, NICE, Genesys provide pre-built orchestration frameworks

- Direct Implementation: Build custom agent coordination using foundation model APIs

- Enterprise Reality: Most organizations will use hybrid approaches - vendor platforms for standard workflows, custom development for unique business processes

📈 Week's Key Enterprise Insight: The Platform Consolidation Accelerates

The enterprise AI landscape is experiencing rapid consolidation around platform providers who can orchestrate multiple AI capabilities. 74% of CXOs expected to increase their technology spend in 2025, but they're choosing comprehensive platforms over point solutions.

Three Enterprise AI Strategies Emerging:

- Microsoft-Centric: Leverage Copilot Studio's multi-agent orchestration across existing Microsoft investments

- Best-of-Breed Platform: Combine specialized vendors (NICE/Genesys for contact center, Salesforce for CRM) with integrated AI capabilities

- Cloud-First Hybrid: Use cloud provider AI services (AWS, Google, Azure) with selective vendor integrations

The Strategic Reality: Industries like healthcare, finance, and retail will lead AI adoption, leveraging AI for precision diagnostics, fraud detection, and hyper-personalized customer engagement. However, as companies become more skilled in orchestrating and governing AI agents, they may create AI-agent based workforces in different geographies - fundamentally changing enterprise operations.

👀 What Enterprises Should Watch This Week

Microsoft Build Follow-Through

Monitor how Microsoft's multi-agent orchestration performs in real enterprise deployments. The Agent2Agent (A2A) protocol support could become the enterprise standard for AI interoperability.

Contact Center Vendor Differentiation

There's a big difference between developing a studio for autonomous AI and renaming pre-existing AI tools while expecting people to think it's a breakthrough. Watch for actual customer deployments beyond vendor demos.

Enterprise AI Agent Governance

As HR manages a workforce that has both humans and AI agents, it will need different skills and new ways to source, develop and measure human talent. Early governance frameworks will determine long-term AI adoption success.

Critical Success Factors to Monitor:

- Multi-agent workflow reliability in production environments

- Enterprise data integration complexity across vendor boundaries

- Cost optimization as AI usage scales from experimental to operational budgets

The enterprise AI platform wars are intensifying, but the winners won't be determined by the most advanced AI - they'll be the vendors who can orchestrate multiple AI capabilities into seamless business workflows while maintaining enterprise security, governance, and cost predictability.

Sources and References:

[1] 2025 release wave 2 plans for Microsoft Dynamics 365, Microsoft Power Platform, and Role-based Microsoft Copilot offerings, Microsoft Dynamics 365 Blog, July 16, 2025

[2] Multi-agent orchestration and more: Copilot Studio announcements, Microsoft Copilot Blog, May 19, 2025

[3] What's new in Copilot Studio: May 2025, Microsoft Copilot Blog, May 2025

[4] NiCE, Genesys, & Five9 Have All Released AI Agent Studios, CX Today, July 17, 2025

[5] New Five9 Fusion for Salesforce Deepens Partnership, Five9, April 30, 2025

[6] Big CX News from NiCE, Genesys, Salesforce, & Gartner, CX Today, June 20, 2025

[7] 2025 Contact Center as a Service Worldwide Market Share Report, ResearchAndMarkets.com, July 18, 2025

[8] How 100 Enterprise CIOs Are Building and Buying Gen AI in 2025, Andreessen Horowitz, June 19, 2025

[9] Dell Technologies Unveils Next Generation Enterprise AI Solutions with NVIDIA, Dell Technologies, May 19, 2025

[10] 2025 Predictions for Enterprise AI, AI21, March 28, 2025