Enterprise AI Intelligence Weekly: NICE's $955M Cognigy Bet Signals Consolidation Endgame

🎯 Big Picture Enterprise Summary: NICE's $955 million acquisition of Cognigy, announced July 28, 2025, marks the largest enterprise AI vendor consolidation play of the year and signals the end of standalone conversational AI companies. With AI agent companies leading M&A activity and securing the 3 largest deals among 85 acquisitions in Q1'25, enterprises must prepare for a dramatically consolidated vendor landscape where platform integration trumps point solutions.

🏢 The NICE-Cognigy Deal: Strategic Masterstroke or Expensive Gamble?

The Numbers That Matter:

- Deal valued at approximately $955 million, more than 25 times Cognigy's revenue multiple of $37 million in 2024

- NICE stock jumped 7.9% in pre-market trading following the announcement

- Cognigy serves over 1,000 brands worldwide including Allianz, Bosch, DHL, Lufthansa, Mercedes-Benz, Nestle, and Toyota

- Expected to close in Q4 2025, subject to US and German regulatory approval

Enterprise Translation:

- Best For: Large enterprises seeking unified AI orchestration across front and back office operations

- Cost Impact: Wedbush analysts predict the deal could double NICE's AI and self-service ARR by year-end 2026, add 150 to 250 basis points to cloud revenue growth

- Risk Factors: 25x revenue multiple raises integration pressure and ROI expectations

- Adoption Timeline: Integration expected throughout 2026, full value realization by 2027

💡 Key Enterprise Insight: Understanding the AI Architecture Landscape

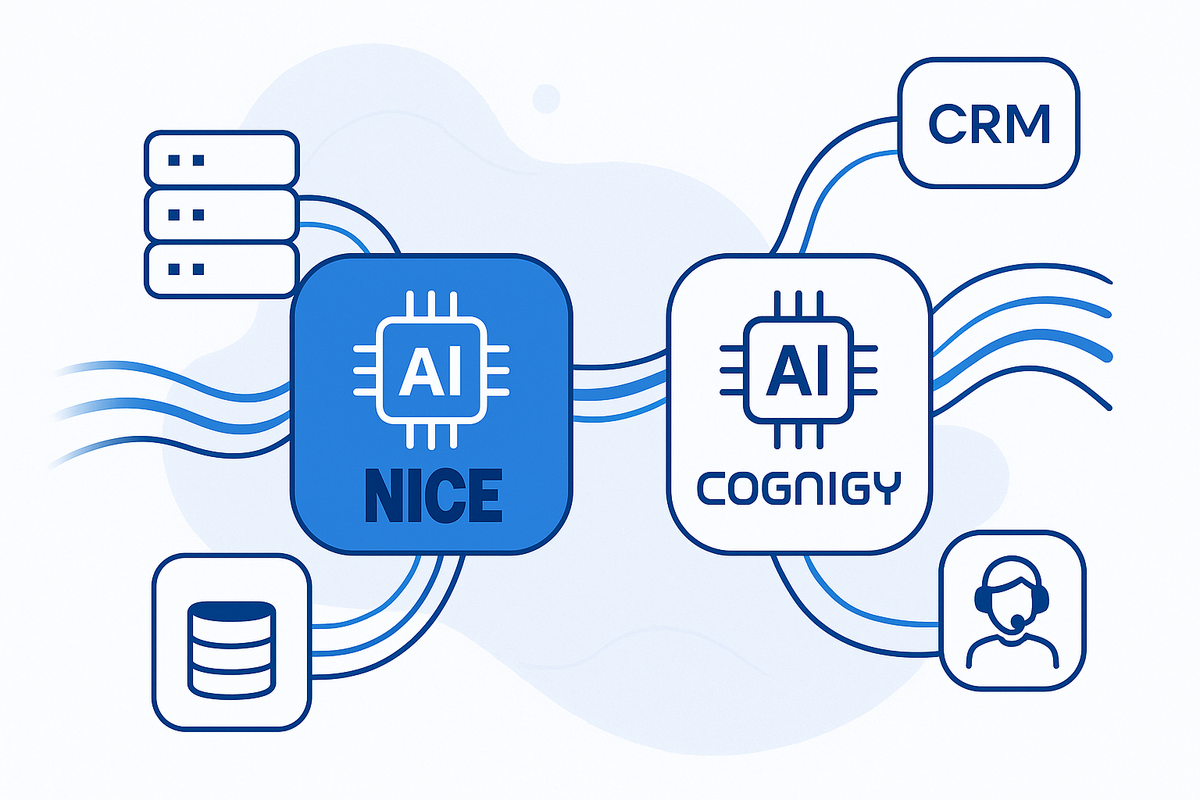

The Platform Reality: This acquisition highlights the fundamental architecture choices enterprises face when implementing AI. NICE isn't acquiring proprietary AI models—they're buying sophisticated orchestration software that connects to third-party LLMs from OpenAI, Anthropic, Google, and others.

The Operational Context: From an operations perspective, there are essentially two approaches to enterprise AI implementation:

Traditional LLM Approach (What Cognigy Provides):

- Every customer query flows through expensive foundation models ($0.01-0.10 per interaction)

- Requires complex prompt engineering and response management

- Depends on third-party API availability and pricing

- Introduces latency (1-3 seconds per response)

Direct Database Integration Approach:

- Simple queries (account balance, order status, policy lookup) bypass LLMs entirely

- Direct API connections to CRM/ERP systems provide instant, accurate responses

- LLMs only engaged for complex reasoning or creative tasks

- Cost reduction of 80-90% for routine interactions

Why This Architecture Choice Matters: Most contact center interactions are structured data requests that don't require AI creativity—they need fast, accurate database lookups with natural language interfaces.

📊 The Consolidation Reality Check

Market Momentum: Strategic moves skew toward acquisition, with venture capital funding topping $100 billion in 2024, but deals concentrating around fewer late-stage players, signaling future consolidation.

Enterprise Buyer Behavior: 66% of enterprises concentrate 80% of IT spend with just 25 or fewer vendors, while 82% are actively pursuing supplier reduction to eliminate redundancies and simplify management.

The Winners and Losers:

- Winners: Platform vendors with acquisition capital (Microsoft, Salesforce, NICE, Genesys)

- Losers: Standalone AI vendors without clear integration paths

- Enterprise Impact: Fewer vendor relationships but deeper platform lock-in

⚖️ NICE-Cognigy: The Good, The Bad, The Strategic

✅ Strategic Positives:

Market Leadership Combo: Cognigy was "one of the first movers with an agentic AI solution introduced last November (2024)" combined with NICE's enterprise distribution creates immediate market dominance.

Technical Integration: The strategic acquisition combines NICE's CXone Mpower platform with Cognigy's orchestration capabilities. Cognigy integrates with "top providers such as OpenAI, Azure, Anthropic, Amazon Bedrock, Google, and Aleph Alpha" through API connections, enabling enterprises to deploy AI agents across multiple channels and languages through a unified interface.

Customer Base Synergy: Cognigy has approximately 300 employees, about 50 of whom are located in the US. All of Cognigy's employees are expected to transition to NICE, including executive management - preserving institutional knowledge and customer relationships.

⚠️ Strategic Considerations:

Architecture Dependency: Cognigy operates as an orchestration layer that "connects to an LLM provider of your choice via API." This creates ongoing operational dependencies on OpenAI, Anthropic, and other foundation model providers for core functionality, requiring enterprises to manage multiple vendor relationships and API costs.

Operational Complexity: At 25x revenue, NICE must achieve aggressive integration and growth targets to justify the premium. The success depends heavily on seamless platform integration and the ability to demonstrate clear ROI improvements over existing implementations.

Market Positioning: Cognigy has established relationships with six major contact center software companies and is a premium application on the Genesys AppFoundry. NICE now owns technology that operates across competing platforms while building their own unified ecosystem.

🔄 What This Means for Enterprise AI Strategy

White Label and Partnership Evolution: The acquisition creates interesting dynamics for existing vendor relationships. NICE's current partnerships with specialized AI providers may continue through white label arrangements, while also opening new market access opportunities for partners to reach NICE's broader customer base.

Platform vs. Build Decision Framework: Enterprises now face clearer choices:

- Comprehensive Orchestration: Full-platform solutions that manage multiple AI models and workflows

- Selective Integration: Direct database connections for routine queries, LLM processing for complex tasks

- Hybrid Approach: Best-of-breed AI vendors for specialized functions within broader platform ecosystems

Procurement Implications: As consolidation accelerates, enterprises should evaluate:

- Which AI capabilities require platform management vs. direct integration

- How existing vendor relationships will evolve within consolidated platforms

- Whether to standardize on single platforms or maintain multi-vendor flexibility

👀 What Enterprises Should Watch Next

Immediate Market Reactions:

- How Genesys, Five9, and Amazon Connect respond to NICE's expanded AI capabilities

- Whether Microsoft accelerates Copilot Studio acquisitions to compete

- Salesforce's potential counter-moves in conversational AI space

Integration Execution:

- NICE's ability to maintain Cognigy's innovation pace post-acquisition

- Customer retention during the transition period

- Technical integration timeline and feature roadmap

Regulatory Approval Process:

- US and German regulatory review of the transaction

- Potential competitive concerns given NICE's market position

- Timeline implications for Q4 2025 closing target

🎯 Enterprise Action Framework

For Current NICE Customers:

- Evaluate how Cognigy integration affects existing roadmaps

- Negotiate transition protection in current contracts

- Plan for expanded AI capabilities in 2026-2027 budgets

For Current Cognigy Customers:

- Assess long-term strategic alignment with NICE platform

- Evaluate alternative vendors as backup options

- Negotiate service level continuity guarantees

For All Enterprises:

- Accelerate vendor consolidation strategies before prices increase

- Evaluate AI platform providers with acquisition capital

- Prepare for a more concentrated but less flexible vendor landscape

The Bottom Line: NICE's Cognigy acquisition represents a strategic investment in AI orchestration capabilities that will enable enterprises to manage multiple foundation models through a unified platform. The 25x revenue multiple reflects the market's recognition that AI integration and management - not just access to AI models - creates significant operational value.

For enterprises, this signals the importance of understanding the difference between AI technology (foundation models) and AI operations (orchestration platforms). Success will depend on choosing the right architecture for your specific use cases: direct database integration for routine queries, orchestration platforms for complex multi-model workflows, and strategic vendor relationships that align with long-term operational requirements.

Sources and References:

[1] NICE stock surges after $955 million Cognigy acquisition announcement, Investing.com, July 28, 2025

[2] NICE Accelerates Agentic AI Focus with Cognigy Acquisition, NoJitter, July 28, 2025

[3] NICE to Acquire Cognigy Advancing the Leading CX AI Platform, NICE Press Release, July 28, 2025

[4] NICE to acquire German AI firm Cognigy in $955M deal, Proactive Investors, July 28, 2025

[5] State of AI Q1'25 Report, CB Insights Research, May 19, 2025

[6] New NPI Research Reveals How AI, Vendor Consolidation, and Rising Costs Are Reshaping Enterprise IT Sourcing in 2025, NPI, June 26, 2025

[7] Enterprise AI Market - Share, Trends & Size 2025-2030, Mordor Intelligence, June 22, 2025