Enterprise AI Intelligence Weekly: The Great Enterprise Shakeup - Anthropic Overtakes OpenAI as Multi-Agent Reality Sets In

Multi-Agent vs. Single Agent: The Enterprise Performance Gap

Single AI Agent Scenario: A customer calls saying "I need to dispute a charge, check my available credit, and update my address."

Traditional AI: One agent tries to handle billing disputes, credit checks, and account management - often gets confused switching between different systems and provides generic responses because it's trying to be expert at everything.

Multi-Agent Orchestration: The same customer call triggers:

- Billing Agent: Processes the dispute and documents the case

- Credit Agent: Checks available credit and applies temporary adjustments

- Account Agent: Updates address across all systems and verifies identity

- Coordinator Agent: Manages the workflow and provides unified customer communication

Result: Each specialist agent handles what it does best, then shares information to solve the complete problem - just like a human customer service team would collaborate.

Why This Matters for Enterprises: The data shows multi-agent systems can handle complex business processes that require multiple areas of expertise, while single agents excel at focused, repetitive tasks.

🎯 Big Picture Enterprise Summary

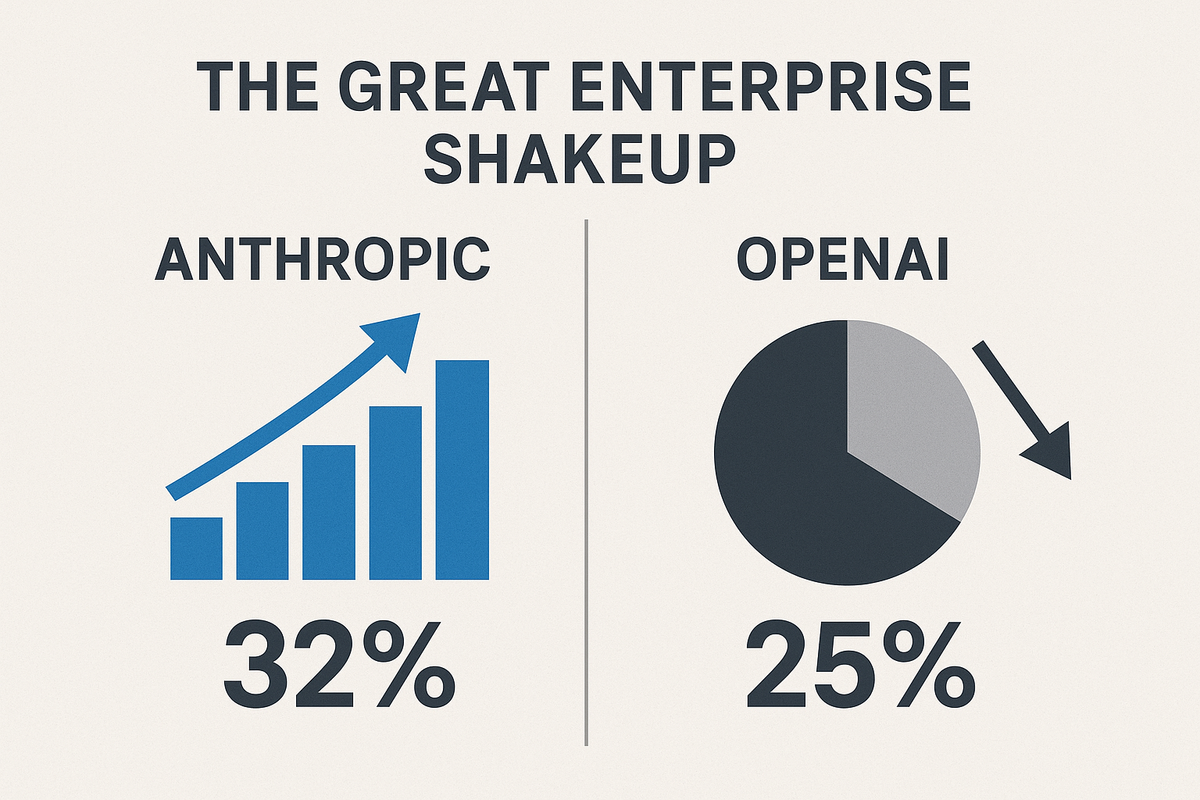

The enterprise AI landscape experienced its most dramatic reversal since ChatGPT's launch, with Anthropic overtaking OpenAI to capture 32% of enterprise market share, while OpenAI's revenue doubles to $1 billion monthly. This split signals the maturation of enterprise vs. consumer AI strategies. Meanwhile, Google launches its first multi-agent system with Gemini 2.5 Deep Think, and OpenAI releases ChatGPT agent to Pro, Plus, and Team users, marking the transition from single-model AI to orchestrated agent teams as the new enterprise battleground.

🏢 Vendor Platform Intelligence

Anthropic's Enterprise Dominance Play

In the most significant market shift since OpenAI's consumer breakthrough, Anthropic now holds 32% of enterprise large language model market share by usage, according to a report from Menlo Ventures. This represents a dramatic reversal from just two years ago when OpenAI held 50% of the enterprise market share while Anthropic had 12%.

Enterprise Translation:

- Best For: Enterprises prioritizing coding tasks and technical documentation

- Cost Impact: Enterprise usage of Anthropic's AI models are more than double OpenAI's when it comes to coding, which garnered 21% of overall market share

- Risk Factors: Still faces ongoing lawsuit over using books without permission to train its system

- Adoption Timeline: Anthropic's release of its Claude 3.5 Sonnet model in June 2024 is what laid the foundation for the company's surge in usage

Key Technical Breakthrough: In an example of models with comparable intelligence, Gemini 2.5 flash costs 26 cents / million tokens while GPT-4.1 mini costs 70 cents, but enterprises are choosing performance over price when selecting Anthropic for specialized tasks.

Contact Center Platform Wars: Leadership Changes

The contact center AI landscape saw major leadership shakeups and strategic positioning this week.

Five9's Strategic Restructuring: Five9 has ousted three senior executives: Niki Hall, Chief Marketing Officer, Jim Doran, EVP of Corporate Strategy, and Tricia Yankovich, Head of HR. This marks Five9's third round of layoffs in less than 12 months, following a seven percent and a four percent workforce reduction in August 2024 and May 2025, respectively.

ServiceNow and Salesforce Make Enterprise Play: ServiceNow and Salesforce will invest $1.5 billion in Genesys, a cloud customer experience platform, while Genesys Cloud AI continues to be an industry leader in growth and innovation, demonstrated by accelerated customer adoption of standalone AI products that contributed to more than 10% of Genesys Cloud bookings.

Market Reality Check: NiCE, Genesys, and Five9 have recently launched AI studios, supporting brands in building AI agents that interact with customers. However, there's a big difference between developing a studio for autonomous AI and renaming pre-existing AI tools while expecting people to think it's a breakthrough.

Enterprise Budget Reality: The $8.4B Market

Enterprise spending on large language models (LLM) has more than doubled from $3.5 billion in late 2024 to $8.4 billion by mid-2025. This acceleration comes as enterprises move beyond experimentation to production deployment.

Multi-Model Strategy Becomes Standard: Organizations are much more sophisticated at mixing and matching multiple models to optimize across both performance and cost. Enterprise buyers are discovering that "Anthropic is a bit better at writing tasks—language fluency, content generation, brainstorming—while OpenAI models are better for more complex question-answering".

🔄 Foundation Model Integration Spotlight

The Multi-Agent Architecture Revolution

Google's Multi-Agent Breakthrough: Google released its first publicly available "multi-agent" AI system, which uses more computational resources, but produces better answers. First unveiled in May at Google I/O 2025, Gemini 2.5 Deep Think is Google's first publicly available multi-agent model. These systems spawn multiple AI agents to tackle a question in parallel.

OpenAI's Agent Evolution: ChatGPT agent starts rolling out today to Pro, Plus, and Team; Pro will get access by the end of day, while Plus and Team users will get access over the next few days. This represents OpenAI's move beyond single-model interactions to agent-based workflows.

AWS Platform Strategy: AWS announced updates to the open source SDK Strands Agents, a new developer tool that makes it dramatically easier to create AI systems where multiple AI agents work together to solve complex problems. The technology reduces what previously took months of complicated technical work into a process that takes just hours.

Enterprise Infrastructure Investments

The $300 Billion AI Arms Race: Microsoft leads the charge with plans to spend $100 billion in capital expenses next year, including a record $30 billion this quarter, with the vast majority dedicated to AI infrastructure, while Google-parent Alphabet announced it will invest $75 billion in AI this year, 29% greater than Wall Street expectations.

Microsoft's Model Diversification: Microsoft Corp. has developed a series of large language models that can rival algorithms from OpenAI and Anthropic PBC. Sources indicate the LLM series is known as MAI. That's presumably an acronym for "Microsoft artificial intelligence".

💡 Key Enterprise Term Definition: Multi-Agent Orchestration

Traditional AI Approach: Single AI model handles one task at a time sequentially Multi-Agent Orchestration: Multiple specialized AI agents work together, delegating tasks and sharing results to complete complex workflows in parallel

Vendor vs. Direct Implementation:

- Vendor Platforms: AWS AgentCore, Microsoft Azure AI Foundry, Google Cloud AI provide pre-built orchestration frameworks

- Direct Implementation: Build custom agent coordination using foundation model APIs and open-source tools like AutoGen

- Enterprise Reality: 99% of developers building AI applications for enterprise said they are exploring or developing AI agents

📈 Week's Key Enterprise Insight: The Reality Check Begins

The Market Maturation: Last year, big tech couldn't stop talking about how AI "agents" would be the next big thing in 2025. It hasn't quite turned out that way. However, "2025 is going to be the year of the agent" according to IBM research, but with important caveats.

The Enterprise Readiness Gap: "Most organizations aren't agent-ready. What's going to be interesting is exposing the APIs that you have in your enterprises today. That's where the exciting work is going to be. And that's not about how good the models are going to be. That's going to be about how enterprise-ready you are".

Three Enterprise AI Strategies Emerging:

- Multi-Vendor Best-of-Breed: Use Anthropic for coding, Google for cost efficiency, OpenAI for complex reasoning

- Platform Consolidation: Microsoft's comprehensive AI ecosystem or AWS's agent marketplace approach

- Hybrid Orchestration: Amazon Bedrock AgentCore enables organizations to deploy and operate secure AI agents at enterprise scale with seven core services

The Performance Premium Reality: While enterprises debate vendor selection, OpenAI now generates approximately $1 billion per month in revenue, up from $500 million per month at the start of 2025, proving that premium performance commands premium pricing in the enterprise market.

👀 What Enterprises Should Watch This Week

Multi-Agent Production Deployments

Monitor how enterprises move beyond single-agent pilots to production multi-agent workflows. Companies like Unilever achieved results in weeks by automating high-volume hiring stages, suggesting rapid implementation timelines for well-scoped use cases.

Vendor Consolidation vs. Best-of-Breed

The market is showing two distinct approaches: comprehensive platform strategies (Microsoft, AWS) versus specialized vendor combinations. 67% of OpenAI users have deployed non-frontier models in production, compared to just 41% for Google and 27% for Anthropic, indicating enterprises value ecosystem breadth.

Enterprise API Readiness

"Most organizations aren't agent-ready" because of API exposure challenges, not model capabilities. The competitive advantage will come from enterprise systems integration, not AI model selection.

Critical Success Factors to Monitor:

- Multi-agent workflow reliability in production environments across vendor boundaries

- Enterprise data integration complexity as the bottleneck to agent deployment

- Cost optimization strategies as spending scales from $8.4B to projected growth

The enterprise AI landscape is experiencing its most significant structural shift since generative AI emerged. The winners won't be determined by the most advanced AI models—they'll be the organizations and vendors who can orchestrate multiple AI capabilities into seamless, enterprise-ready workflows while maintaining security, governance, and cost predictability.

The bottom line: Anthropic's enterprise dominance signals that performance in specific domains (like coding) matters more than general capabilities, while the multi-agent revolution requires enterprises to think beyond single-model strategies to orchestrated AI ecosystems.

Sources and References:

[1] Enterprises prefer Anthropic's AI models over anyone else's, including OpenAI's, TechCrunch, July 31, 2025

[2] Top AI Business Stories: Week of July 28 - August 3, 2025, FourWeekMBA, August 3, 2025

[3] How 100 Enterprise CIOs Are Building and Buying Gen AI in 2025, Andreessen Horowitz, June 19, 2025

[4] Google rolls out Gemini Deep Think AI, a reasoning model that tests multiple ideas in parallel, TechCrunch, August 1, 2025

[5] Introducing ChatGPT agent: bridging research and action, OpenAI, 2025

[6] AWS announces new innovations for building AI agents at AWS Summit New York 2025, Amazon, July 15, 2025

[7] AI Agents in 2025: Expectations vs. Reality, IBM, July 30, 2025

[8] AI Agents have, so far, mostly been a dud, Gary Marcus, August 3, 2025

[9] Five9 Lays Off Three Senior Execs with Broader Jobs Cuts to Come, CX Today, July 31, 2025

[10] ServiceNow, Salesforce invest $1.5 billion in Genesys as Five9 CEO retires, Constellation Research, August 1, 2025