Implementation Friday: Master Agent for Multi-Vendor AI Performance Monitoring

Important Disclaimer

This is a hypothetical implementation guide based on current market analysis and enterprise AI vendor capabilities. Actual costs, development timelines, and technical requirements may vary significantly based on organizational size, infrastructure complexity, vendor relationships, and implementation scope. These estimates should be used for initial planning purposes only and require detailed analysis specific to your enterprise environment.

Strategic Blueprint Overview

Rather than paying 40-60% premiums for vendor consolidation, enterprises can build intelligent oversight systems that maintain best-of-breed vendor performance while eliminating accountability gaps. This implementation guide demonstrates how to construct a Master Agent system that monitors multiple AI vendors in real-time, provides unified SLA tracking, and delivers automated root cause analysis.

The Enterprise Challenge: Multi-Vendor Accountability Gap

Real-World Scenario: MidState Financial (1,200 employees, 1.8M monthly interactions) deployed three specialized AI vendors to optimize costs:

Current Hybrid Vendor Setup:

- NICE CXone (Backbone Platform): Core contact center infrastructure - $85,000/month

- Omilia Voice AI (Specialized Add-on): Advanced voice authentication - $18,000/month

- DataSphere Fraud Detection (Specialized Add-on): Real-time fraud analysis - $12,000/month

- Total Hybrid Monthly Cost: $115,000

Enterprise Platform Alternative:

- Full NICE Platform with Premium AI Modules: Estimated $150,000-180,000/month (based on $125-150 per seat for 1,200 seats)

- Consolidation Premium: 30-60% higher cost vs. hybrid approach

The $174K Annual Problem: When issues arise, finger-pointing between vendors creates 2-week delays identifying root causes, leading to customer frustration and operational costs.

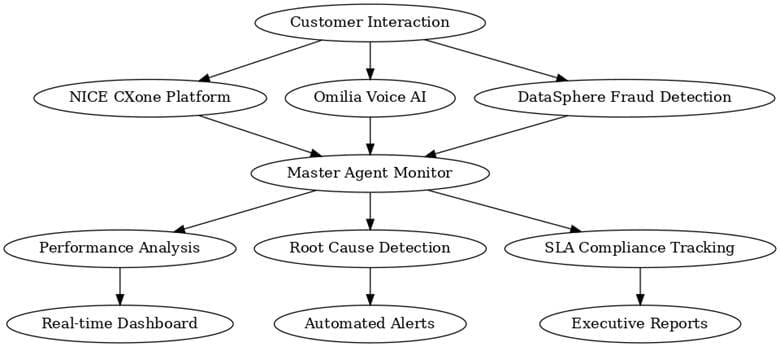

Master Agent Architecture: What It Monitors

Core Monitoring Framework

What the Master Agent Monitors

Platform Performance Metrics:

- Response Times: API latency across all vendor integrations

- Success Rates: Task completion percentages by vendor

- Error Patterns: Failure correlation across multiple systems

- Resource Utilization: System load and capacity metrics

Customer Experience Indicators:

- End-to-End Journey Tracking: Complete interaction flow monitoring

- Quality Scores: Customer satisfaction correlation with vendor performance

- Escalation Patterns: When and why customers require human intervention

Vendor SLA Compliance:

- Uptime Monitoring: Real-time availability tracking

- Performance Benchmarks: Contractual obligation adherence

- Cost per Interaction: ROI analysis across vendor portfolio

What the Master Agent Reports to Your Company

Real-Time Operations Dashboard

System Health Overview:

- Visual status map of all AI agents with color-coded performance indicators

- Current customer impact metrics with satisfaction correlation

- Live SLA compliance percentages against contractual obligations

Weekly Vendor Performance Reports

Automated Monday Morning Summary:

MidState Financial - Weekly Vendor Performance Report

Week of: March 18-24, 2025

EXECUTIVE SUMMARY:

✅ Overall SLA Compliance: 96.2% (Target: 95%)

⚠️ Omilia voice routing accuracy declined 2.1% week-over-week

✅ Salesforce chat resolution improved 4.3% after training update

FINANCIAL IMPACT:

- Cost avoidance vs. consolidated platform: $73,200 this month

- Performance-based optimization opportunities: $12,400 identified

- Vendor accountability recovery: $8,900 in SLA credits processed

VENDOR RECOMMENDATIONS:

1. Omilia: Schedule performance review - accuracy trending down

2. Salesforce: Consider expanding deployment - strong ROI shown

3. DataSphere: Investigate optimization - response times affecting UX

Monthly Strategic Analysis

Vendor ROI Scorecards:

- Performance rankings with trend indicators

- Cost per interaction analysis across all vendors

- Contract renewal recommendations based on objective data

Risk Assessment Reports:

- Vendor dependency analysis and diversification recommendations

- Performance prediction models for capacity planning

- Competitive landscape analysis for vendor negotiation leverage

High-Level Implementation Architecture

Technical Stack Overview

Foundation Infrastructure:

- Cloud Platform: AWS/Azure for scalability (estimated $3,500/month)

- Intelligence Layer: Claude API for analysis and reporting ($1,200/month)

- Monitoring Framework: Prometheus + Grafana for visualization ($800/month)

- Database: PostgreSQL for metrics, TimeSeries for real-time data

Integration Components:

- Vendor API Connectors: Custom adapters for each AI vendor's monitoring APIs

- Unified Data Layer: Standardized performance metrics across all systems

- Alert Management: Intelligent escalation with vendor-specific action items

Implementation Timeline

Phase 1 (Weeks 1-4): Foundation Setup

- Deploy monitoring infrastructure

- Connect vendor APIs

- Establish baseline performance metrics

Phase 2 (Weeks 5-8): Intelligence Layer

- Implement Claude-powered analysis engine

- Deploy real-time alerting system

- Create root cause detection algorithms

Phase 3 (Weeks 9-12): Reporting & Analytics

- Build executive dashboards

- Deploy automated reporting system

- Establish vendor accountability workflows

Cost-Benefit Analysis

Investment Requirements

Initial Development (3-month implementation):

- Development Team: $120,000 (2 developers × 3 months)

- Infrastructure Setup: $15,000 (cloud resources, monitoring tools)

- Claude API Usage: $2,000 (analysis and reporting)

- Third-party Tools: $8,000 (monitoring, alerting, dashboard software)

- Total Initial Investment: $145,000

Monthly Operational Costs:

- Cloud Infrastructure: $3,500/month

- Claude API Usage: $1,200/month

- Monitoring Tools: $800/month

- Maintenance & Support: $2,000/month

- Total Monthly Cost: $7,500

ROI Comparison

Annual Cost Analysis:

- Hybrid Approach with Master Agent: $1,470,000 (vendors + monitoring)

- Full Enterprise Platform Consolidation: $1,800,000-2,160,000 (estimated based on $150-180K monthly)

- Annual Savings: $330,000-690,000

Value Beyond Cost Savings:

- 70% faster vendor issue identification and resolution

- Objective performance data for contract negotiations

- Maintained best-of-breed capabilities without vendor lock-in

- Total Annual Value: $1,395,000+ in cost avoidance and operational improvements

- Net ROI: 400-900% return on investment (varies by enterprise platform pricing)

Critical Success Factors

Vendor Relationship Management

- Focus on published API data and contractual SLA enforcement

- Maintain vendor neutrality while ensuring accountability

- Use objective performance data to strengthen vendor partnerships

Technical Implementation Best Practices

- Start with existing vendor APIs rather than requiring new integrations

- Implement gradual rollout to build organizational confidence

- Ensure high availability architecture for continuous monitoring

Change Management

- Executive sponsorship for vendor accountability initiatives

- Clear ROI demonstration through documented cost savings

- Training programs for IT teams on new monitoring capabilities

Next Steps for Implementation

Immediate Actions (Week 1):

- Infrastructure Assessment: Review current cloud capabilities and security requirements

- Vendor API Documentation: Collect monitoring API documentation from all current AI vendors

- Team Assembly: Identify 2 developers and 1 project manager for 3-month implementation

- Budget Approval: Secure $145,000 initial development budget plus $90,000 annual operational budget

30-Day Success Criteria:

- All vendor APIs successfully integrated with monitoring framework

- Basic performance monitoring operational with baseline data collection

- Initial dashboard providing unified view of vendor performance

- Documented cost savings vs. vendor consolidation alternative

The Bottom Line: Rather than paying 30-60% consolidation premiums or accepting unmanaged multi-vendor complexity, the Master Agent approach delivers intelligent oversight that maintains best-of-breed performance while ensuring vendor accountability.

Organizations implementing this approach gain sustainable competitive advantages through optimized AI vendor portfolios, reduced operational overhead, and data-driven vendor management - all while avoiding the substantial consolidation costs that are reshaping the enterprise AI landscape.