Implementation Friday: The Voice AI Agent Maturity Model - From Single Agent to Governed Ecosystem

Strategic Blueprint Overview: Rather than leaping to complex multi-agent systems, successful enterprises build voice AI capabilities through a proven four-phase maturity model. This implementation guide demonstrates how a regional bank or healthcare system can evolve from a single voice agent handling basic inquiries to a sophisticated, governed multi-agent ecosystem managing complex workflows—while maintaining compliance and maximizing ROI at each stage.

The Enterprise Reality: Why Staged Implementation Wins

The Challenge: 80% of AI projects fail due to architectural complexity, but voice AI in contact centers faces an additional hurdle—customer trust. Patients may be skeptical of these technologies due to prior experiences with spam calls, robocalls, and poorly functioning chatbots, while banking customers demand both convenience and security.

The Solution: A maturity-based approach that builds organizational confidence and customer acceptance through incremental value delivery.

Platform Context: Using enterprise-grade platforms like Omilia, which achieves over 90% task completion rate and enables deployment in weeks and achieve quicker time to value, organizations can implement this maturity model with proven infrastructure.

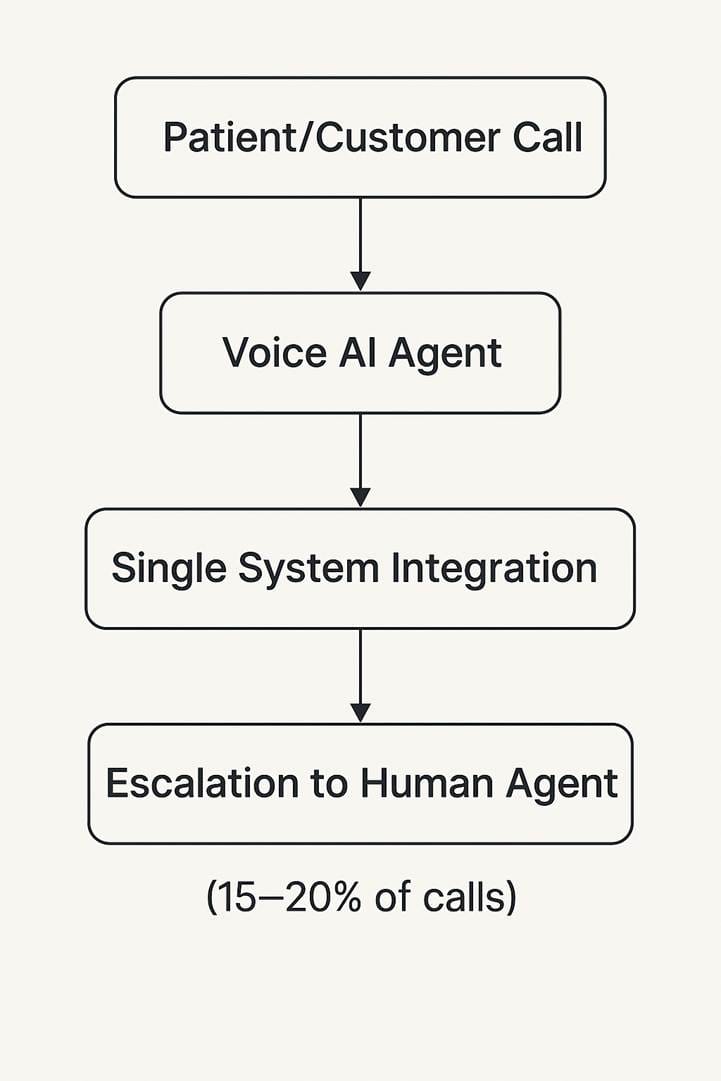

Phase 1: Single Agent Foundation (Months 1-3)

"Prove Value, Build Trust"

Objective: Establish voice AI credibility through focused, high-success use cases while building organizational capabilities.

Enterprise Prerequisites:

- Clean, unified data source (single CRM system)

- Basic compliance framework (HIPAA for healthcare, PCI-DSS for banking)

- Executive sponsorship with realistic expectations

- 3-month pilot budget ($25K-75K for platform setup)

Banking Implementation Example: Target Use Case: Account balance inquiries and transaction history

- Call Volume: 15,000-25,000 monthly interactions

- Success Criteria: 85% task completion, <30 second resolution

- Integration Scope: Core banking system (read-only access)

Healthcare Implementation Example: Target Use Case: Appointment scheduling and basic patient information

- Call Volume: 8,000-15,000 monthly interactions

- Success Criteria: 80% successful bookings, <2 minute call duration

- Integration Scope: Practice management system scheduling module

Expected ROI Metrics:

- Cost Savings: $12K-25K/month in reduced call center labor

- Customer Satisfaction: 75-85% positive feedback on voice interactions

- Agent Productivity: 30% reduction in routine call handling

- Implementation Cost: $25K-75K total

Compliance Framework:

- Banking: Voice biometrics for caller authentication, PCI-DSS data handling

- Healthcare: HIPAA-compliant voice processing, patient consent protocols

Success Indicators for Phase 2:

- Sustained 85%+ task completion rate for 60 days

- Customer satisfaction scores above 75%

- Zero compliance violations

- Internal team confidence in voice AI capabilities

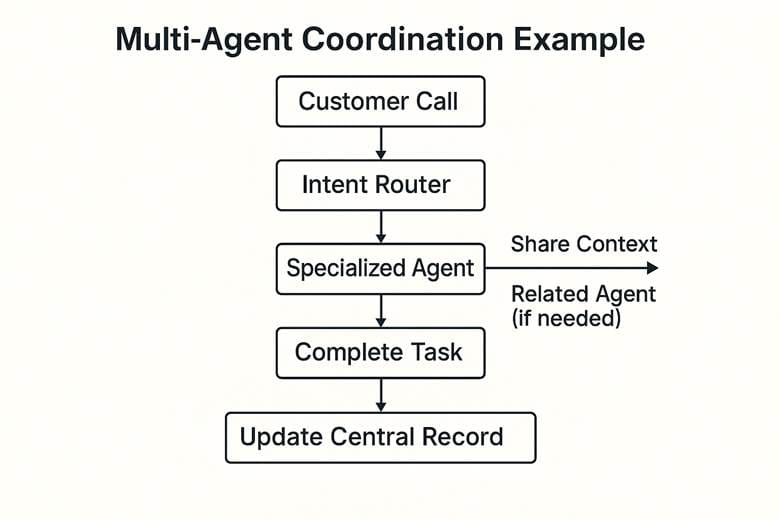

Phase 2: Specialized Agent Expansion (Months 4-8)

"Scale Through Specialization"

Objective: Add complementary voice agents for adjacent tasks while establishing inter-agent communication protocols.

Banking Evolution: New Agents Added:

- Fraud Alert Agent: Handles suspicious transaction notifications

- Payment Agent: Processes bill payments and transfers

- Product Information Agent: Explains banking products and rates

Healthcare Evolution: New Agents Added:

- Insurance Verification Agent: Checks coverage and benefits

- Prescription Refill Agent: Manages medication requests

- Billing Inquiry Agent: Addresses payment questions

Real-World Implementation: A leading multinational financial services company using Omilia's solution implemented this approach: "We selected Omilia over other vendors like Nuance and IBM Watson because it outperformed the competition during our pilot phase, and its solution was less than half the cost."

Results: "Over a period of 12 months, the conversational IVR solution was gradually implemented across all major lines of business, including retail banking, insurance, and direct investing, with value delivered incrementally along the way."

Technical Evolution:

- Agent Communication: REST APIs for context sharing

- Data Integration: Multiple system connections with centralized logging

- Performance Monitoring: Agent-specific metrics and cross-agent workflow tracking

Investment and ROI:

- Additional Investment: $50K-150K for expanded capabilities

- Monthly Savings: $35K-60K through increased automation

- Payback Period: 4-6 months

- Customer Experience: high levels of customer satisfaction with the new self-service experience

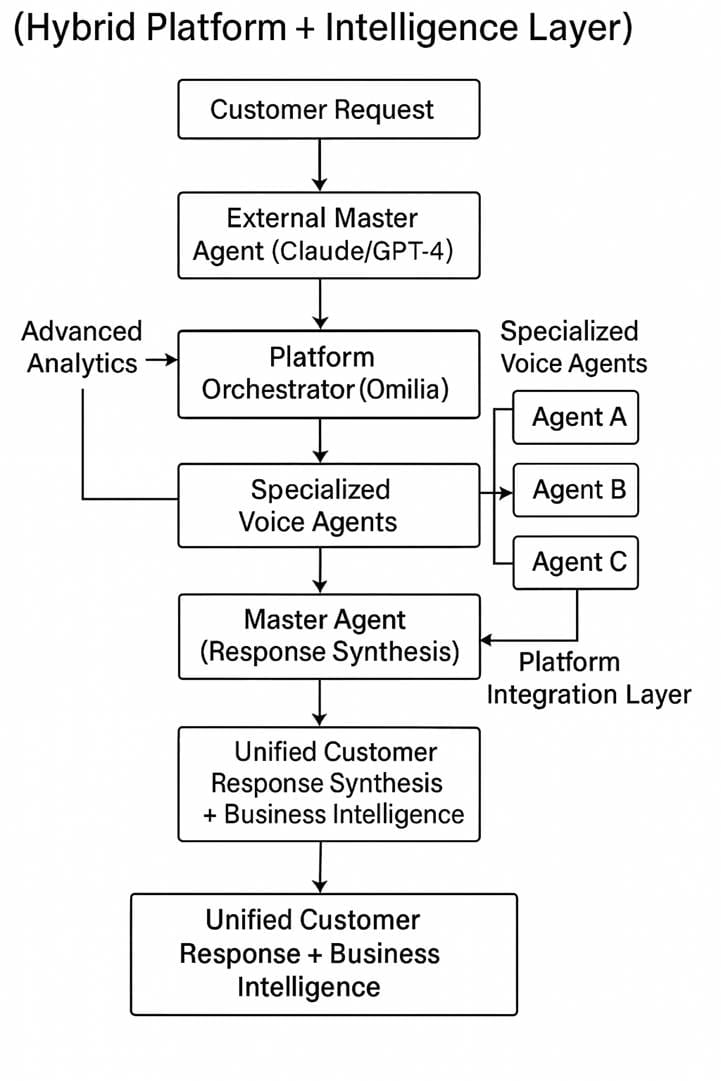

Phase 3: Master Agent Orchestration (Months 9-15)

"Intelligent Workflow Coordination"

Objective: Deploy a Master Agent that coordinates multiple specialized agents and manages complex, multi-step customer requests.

Master Agent Capabilities (Enhanced Platform Architecture):

- Intent Analysis: Determines which specialized agents are needed

- Workflow Orchestration: Manages task sequence and dependencies using platform orchestration capabilities

- Context Management: Maintains conversation state across agent handoffs

- Exception Handling: Escalates to humans when agent coordination fails

- Performance Monitoring: Tracks individual agent effectiveness and overall system performance through external analytics layer

- Reporting Dashboard: Provides real-time analytics on agent utilization, success rates, and workflow bottlenecks via integrated business intelligence

- Quality Assurance: Identifies underperforming agents and recommends optimization strategies

Platform Integration Strategy: While platforms like Omilia provide robust orchestration through their bot Orchestrator® and miniApps framework, enterprises often supplement with external Master Agent intelligence (such as Claude or GPT-4) to provide advanced reasoning, cross-agent performance analytics, and sophisticated workflow optimization that goes beyond platform-native capabilities.

Banking Master Agent Scenario: Complex Request: "I want to dispute a charge, check if it affected my account balance, and make sure my automatic payments won't bounce."

Agent Orchestration:

- Master Agent analyzes multi-intent request

- Fraud Agent initiates dispute process

- Account Agent checks current balance and pending transactions

- Payment Agent reviews upcoming automatic payments

- Master Agent synthesizes information and provides comprehensive response

Healthcare Master Agent Scenario: Complex Request: "I need to reschedule my appointment, check if my insurance covers the procedure, and get my prescription refilled before the visit."

Agent Orchestration:

- Master Agent parses multiple healthcare needs

- Scheduling Agent finds alternative appointment times

- Insurance Agent verifies procedure coverage

- Prescription Agent processes refill request

- Master Agent coordinates timing and provides unified response

Advanced Features:

- Predictive Routing: Master Agent anticipates likely follow-up needs

- Real-time Learning: Continuous improvement through interaction analysis

- Performance Optimization: Dynamic load balancing across specialized agents

Investment and ROI:

- Additional Investment: $100K-300K for orchestration platform

- Monthly Savings: $75K-150K through complex workflow automation

- Customer Experience: 40-60% reduction in multi-touch resolutions

- Agent Efficiency: 50% decrease in complex call escalations

Phase 4: Governance and Compliance Ecosystem (Months 16-24)

"Enterprise-Grade AI Governance"

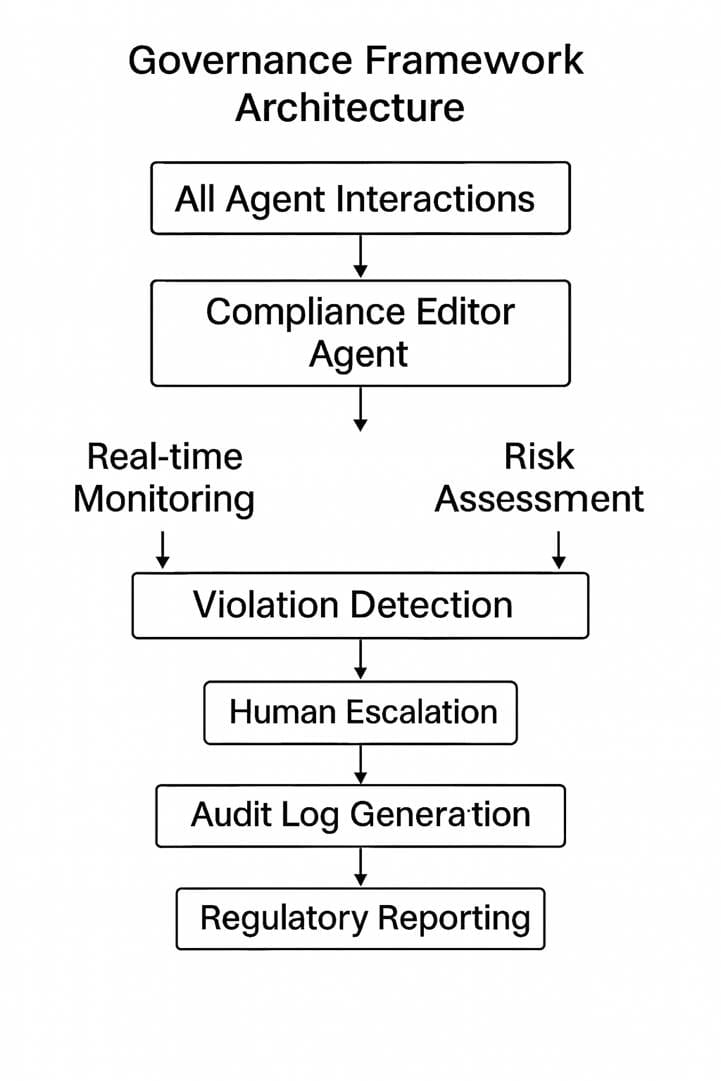

Objective: Add AI Compliance Editor Agent and comprehensive governance framework to ensure regulatory adherence and risk management across the entire voice AI ecosystem.

AI Compliance Editor Agent Functions (Enhanced Governance Layer):

- Real-time Monitoring: Scans all agent interactions for compliance violations using platform-native tools

- Policy Enforcement: Prevents unauthorized information sharing through platform security controls

- Audit Trail Generation: Creates comprehensive logs via platform audit capabilities

- Risk Assessment: Evaluates and flags high-risk interactions for human review

- Master Compliance Oversight: Provides external intelligence layer monitoring the entire agent ecosystem's regulatory performance

- Agent Compliance Scoring: Delivers sophisticated compliance analytics beyond platform-native reporting

- Regulatory Reporting: Generates advanced compliance reports combining platform data with external business intelligence

Platform Foundation: Enterprise platforms like Omilia provide robust compliance infrastructure including PCI-DSS, HIPAA, GDPR, and SOC2 Type II certifications with real-time redaction and anti-fraud mechanisms. Organizations often layer additional AI-powered compliance intelligence (such as Claude-based analysis) to provide advanced risk assessment, pattern recognition, and sophisticated regulatory reporting that enhances platform-native compliance capabilities.

Banking Compliance Scenarios: Regulatory Requirements:

- BSA/AML: Monitor for suspicious activity patterns

- TCPA: Ensure proper consent for outbound calls

- CFPB: Maintain fair lending practice compliance

- State Banking: Adhere to jurisdiction-specific regulations

Compliance Editor Actions:

- Automatically redacts sensitive information from transcripts

- Flags conversations requiring additional verification

- Ensures proper disclosures are provided during financial product discussions

- Monitors for discriminatory language or bias in AI responses

Healthcare Compliance Scenarios: Regulatory Requirements:

- HIPAA: Protect patient health information in all interactions

- FDA: Ensure medical device information is accurately conveyed

- State Medical Boards: Comply with telemedicine regulations

- Medicare/Medicaid: Adhere to billing and coverage guidelines

Compliance Editor Actions:

- Prevents sharing of protected health information without authorization

- Ensures proper medical disclaimers during symptom discussions

- Monitors for potential medical advice overreach

- Maintains detailed audit trails for healthcare audits

Compliance Success Metrics:

- Audit Readiness: 100% of interactions logged and searchable

- Violation Prevention: <0.1% compliance incidents per 10,000 interactions

- Regulatory Response: <24 hours to provide audit documentation

- Risk Mitigation: 99.9% accuracy in sensitive information handling

Investment and ROI:

- Additional Investment: $150K-500K for comprehensive governance platform

- Risk Avoidance: $2M-10M in potential regulatory fines prevented

- Operational Efficiency: 80% reduction in manual compliance monitoring

- Audit Costs: 60-75% decrease in regulatory audit preparation time

Real-World Success Metrics Across All Phases

Proven Platform Performance Results (Based on Omilia Implementations):

- Automation Rate: "We automate 90%+ of customer service inquiries end-to-end, reducing live agent volumes and costs"

- Infrastructure Efficiency: 21 percent decrease in the costs of running contact centers

- Capacity Gains: average increase of 43 percent in call capacity across Omilia's customer base

- Resolution Speed: 50 percent reduction in handling times for customer inquiries

Healthcare Implementation Success:

- Assort Health: "cut hold times from 11 minutes to 1 minute and booked more accurate appointments"

- 100ms: "Your 24/7 on duty agent frees up staff from routine tasks so they can focus on patient care"

- Infinitus: "helped us to support 50% more patients at current staff levels by freeing up tens of thousands of hours per week"

Banking Implementation Success:

- Regional Bank Case Study: Chief Architect reported, "The new platform has allowed us to fulfill more complex transactions in the voice channel with a much more natural conversation, just like you would speak to a human"

- Cost Efficiency: Platform selected because "its solution was less than half the cost" of competitors

- Implementation Speed: Solution was "gradually implemented across all major lines of business... with value delivered incrementally"

Implementation Timeline and Resource Requirements

Implementation Variability Disclaimer: The following timeline and resource estimates represent typical enterprise implementations. Actual requirements vary significantly based on organizational size, technical complexity, existing infrastructure, regulatory requirements, and vendor selection. These estimates should be used for initial planning purposes only.

Phase 1 (Months 1-3): Foundation

- Team Size: 3-5 people (Project Manager, Voice AI Specialist, Integration Developer)

- Budget: $25K-150K total project cost

- Key Milestones: Platform selection, pilot launch, initial success metrics

Phase 2 (Months 4-8): Expansion

- Team Size: 5-8 people (add UX Designer, additional Developers)

- Budget: $50K-250K additional investment

- Key Milestones: Multi-agent deployment, integration expansion, performance optimization

Phase 3 (Months 9-15): Orchestration

- Team Size: 8-12 people (add AI Architect, QA Specialist, Analytics Expert)

- Budget: $100K-500K additional investment

- Key Milestones: Master Agent deployment, complex workflow automation, advanced analytics

Phase 4 (Months 16-24): Governance

- Team Size: 10-15 people (add Compliance Officer, Audit Specialist, Risk Analyst)

- Budget: $150K-750K additional investment

- Key Milestones: Compliance framework, audit readiness, regulatory approval

Critical Success Factors for Each Phase

Technology Foundations:

- Platform Selection: Choose enterprise-grade solutions with proven track records (like Omilia's 90%+ task completion rate)

- Data Quality: Ensure clean, accessible data before agent deployment

- Integration Architecture: Design for scalability from Phase 1

Organizational Readiness:

- Change Management: Prepare staff for new workflows and responsibilities

- Training Programs: Upskill teams on voice AI management and optimization

- Stakeholder Alignment: Maintain executive support through demonstrated ROI

Customer Experience Focus:

- Trust Building: Start with low-risk, high-value interactions

- Feedback Loops: Continuously improve based on customer input

- Human Backup: Always provide clear escalation paths to human agents

Compliance and Risk Management:

- Early Planning: Incorporate compliance requirements from Phase 1

- Regulatory Engagement: Keep compliance teams involved throughout implementation

- Documentation: Maintain detailed records for audit and improvement purposes

Expected Cumulative ROI by Implementation Phase

ROI Variability Note: ROI calculations based on contact center AI maturity research, Omilia platform performance data, and enterprise implementation case studies. Actual returns vary significantly by use case complexity, organization size, existing infrastructure, and implementation quality. These projections should be validated through detailed business case analysis specific to your organization.

Phase 1 Completion:

- Monthly Savings: $12K-40K†

- Customer Satisfaction: 75-85%

- Automation Rate: 60-70% for targeted use cases

Phase 2 Completion:

- Monthly Savings: $35K-80K†

- Customer Satisfaction: 80-90%

- Automation Rate: 75-85% across multiple use cases

Phase 3 Completion:

- Monthly Savings: $75K-200K†

- Customer Satisfaction: 85-95%

- Automation Rate: 85-95% for complex workflows

Phase 4 Completion:

- Monthly Savings: $100K-300K† (including risk avoidance)

- Customer Satisfaction: 90-95%

- Automation Rate: 90-95% with full compliance governance

Total 24-Month ROI: 300-800% depending on organization size and complexity, with full regulatory compliance and enterprise-grade governance capabilities.

†Savings calculations based on average call center labor costs ($45-75/hour loaded), typical call volume reductions (50-90%), and risk avoidance estimates for regulatory compliance. Individual results will vary based on baseline costs, implementation scope, and operational efficiency gains.

The Strategic Advantage: Why This Approach Works

Risk Mitigation: Each phase builds on proven success, reducing implementation risk and ensuring continuous value delivery.

Organizational Learning: Teams develop voice AI expertise gradually, enabling them to make better decisions about advanced capabilities.

Customer Acceptance: Trust builds incrementally as customers experience consistently improving service quality.

Regulatory Compliance: Governance frameworks evolve alongside capabilities, ensuring compliance is built-in rather than bolted-on.

Competitive Positioning: Organizations implementing this maturity model gain sustainable advantages through superior customer experience and operational efficiency.

The voice AI agent maturity model provides a clear path from single-agent pilots to sophisticated, governed multi-agent ecosystems—delivering measurable value at each stage while building toward transformational customer experience capabilities.

Sources and References:

[1] Leading Multinational Financial Services Company Boosts Customer Satisfaction with Conversational AI, Omilia, August 20, 2024

[2] Omilia Conversational Intelligence | Conversational AI solutions, Omilia, August 20, 2024

[3] Contact Center AI Maturity Model, MiaRec, August 7, 2024

[4] The Agentic Maturity Model: A 4-Step Roadmap for CIOs, Salesforce, April 14, 2025

[5] AI in Healthcare Contact Centers, Mosaicx, March 2, 2025

[6] Assort Health | Industry-Leading Generative AI Agents for Call Centers, Assort Health

[7] Automating Complex Healthcare Calls with AI, Infinitus, May 11, 2023

[8] AI Voice Agents for Banking and Finance, Voice.ai, May 14, 2025

[9] How generative AI voice agents will transform medicine, npj Digital Medicine, June 12, 2025

[10] The contact center crossroads: Finding the right mix of humans and AI, McKinsey, March 19, 2025