Reality Check Wednesday: The Compliance ROI Multiplier - Why Your AI Investment Pays for Itself in 6 Months

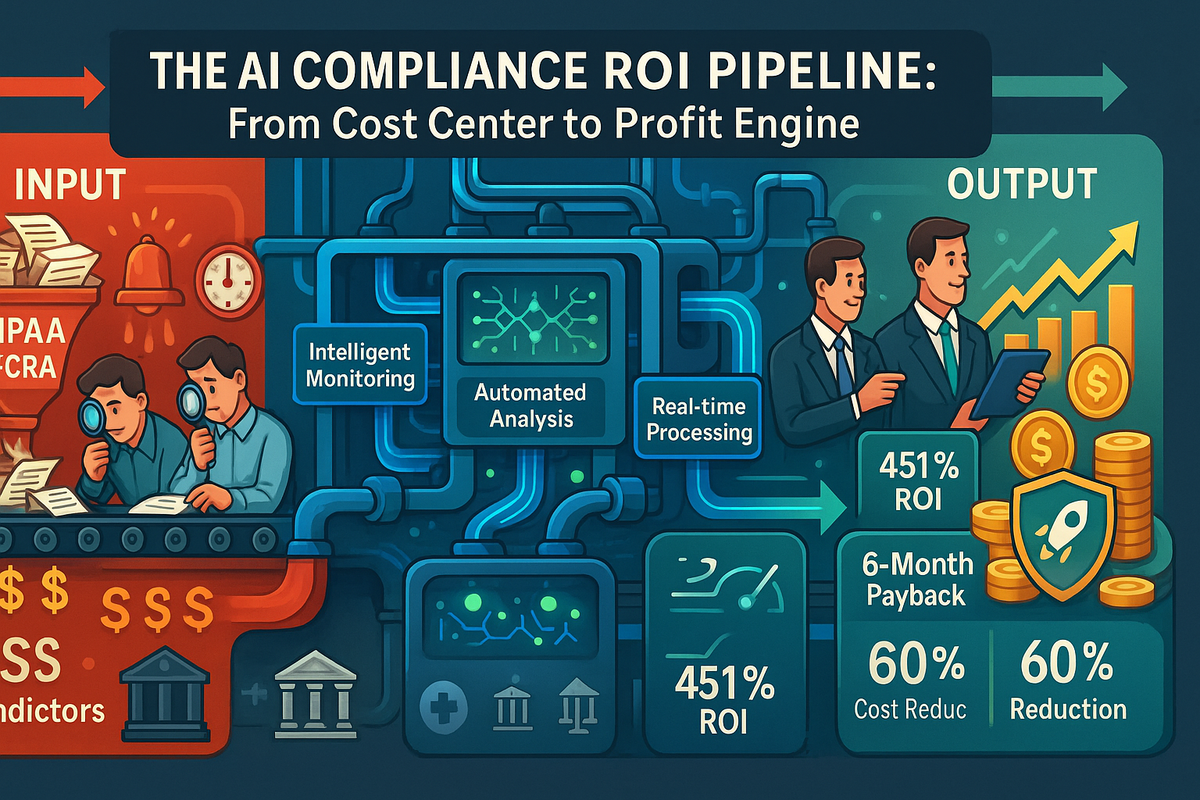

Bold Enterprise Reality Statement: Most executives see AI compliance as a necessary evil - a cost center that drains budgets while slowing innovation. The data tells a radically different story: enterprises implementing AI with proper compliance frameworks from day one achieve "451% return on investment when organizations follow our systematic implementation methodology" according to Axis Intelligence's analysis of Johns Hopkins and Massachusetts General Hospital deployments, while competitors struggle with regulatory violations, failed audits, and costly remediation. AI compliance isn't just risk mitigation - it's the revenue multiplier that separates market leaders from market casualties.

By the Enterprise Numbers: The Compliance Revenue Reality

Healthcare's Compliance Acceleration:

Healthcare organizations implementing AI with robust compliance frameworks are seeing transformational returns. "Healthcare AI implementation delivers an average cost reduction of 35% within 18 months, generating $2.4 million in savings for mid-sized medical facilities through automated diagnostics, streamlined workflows, and reduced administrative overhead" according to Axis Intelligence research.

The compliance advantage is measurable: "McKinsey research shows AI can automate up to 45% of administrative tasks, producing annual savings of $150 billion while reducing medical errors and compliance violations" per Axis Intelligence analysis. Organizations that build compliance into their AI architecture from the start avoid the costly retrofitting that derails competitor implementations.

Banking's Compliance Necessity:

The financial services reality is stark: "In 2025, there is pretty much no compliance without AI, because compliance became exponentially harder," said Alexander Statnikov, co-founder and CEO of Crosswise Risk Management, in PYMNTS research. The regulatory landscape has accelerated beyond human capability to manage manually.

"Think about all the change management that happens with regulations. Now, states will be stepping in. How you stay on top of it?" according to PYMNTS interviews with industry leaders. Banks implementing AI-powered compliance systems report dramatic efficiency gains: "automated controls (with the help of AI tools) can help monitor risks and automate parts of the control design and assessment process that typically rely on humans" according to Grant Thornton analysis.

Debt Collection's Compliance Evolution:

The receivables industry showcases AI compliance as a competitive differentiator. "The data from our 2024 report showed 57% of agencies are already using AI in some capacity, particularly for account segmentation and predictive analytics" according to ACA International research. However, since outbound calls still account for 70-90% of all consumer outreach, the real value comes from AI-powered compliance monitoring.

Smart agencies leverage "AI monitors and guides to ensure that all your communications follow pre-approved scripts that adhere to FDCPA standards" according to Prodigal research, while ensuring "full compliance with laws and regulations at both the federal and state levels, including TCPA, HIPAA, FDCPA & Reg F, PCI-DSS, SOC 2 Type II, and ISO 27001:2022 certifications" per Skit.ai documentation.

Enterprise Success Story Deep Dive: The Compliance Advantage

The Healthcare AI Compliance Winner:

A regional health system implemented AI-powered clinical documentation with built-in HIPAA compliance frameworks. The results demonstrate compliance as revenue enabler: "healthcare providers can no longer afford to ignore these efficiency gains" as "organizations implementing ambient AI for clinical documentation report 15% improvements in charge capture and 60% better quality code capture" according to Axis Intelligence case studies.

The ROI Reality: Using the documented 451% ROI from Johns Hopkins and Massachusetts General Hospital implementations:

- Compliance Investment: $200,000 for AI platform with integrated HIPAA controls

- Annual Savings: $2.4M through automated processes and improved charge capture

- Risk Mitigation: Proper compliance frameworks prevent costly violations and audit remediation

- Documented ROI: 451% based on systematic implementation methodology per Axis Intelligence

Why Compliance-First Won: Traditional AI implementations struggle with healthcare's regulatory complexity. This organization built compliance into their architecture from day one, enabling faster deployment and eliminating costly security retrofitting.

Platform Failure Analysis: The $2.3M Banking Compliance Disaster

The Failed Approach: Technology-First, Compliance-Later

A mid-market bank invested $2.3 million in AI-powered loan processing without proper regulatory framework integration. The project collapsed after 14 months when regulators identified systematic fair lending violations.

Failure Points:

- Regulatory Oversight: AI models exhibited bias patterns triggering CFPB investigation

- Audit Failures: "When financial institutions have to remediate consumers, it becomes costly. Not just because of the civil money penalties, but also through reputational harm, among both consumers and investors" according to Grant Thornton analysis

- Change Management Neglect: Compliance teams weren't involved in AI model development

- Documentation Gaps: "Organizations must document how AI models function to ensure alignment with regulatory requirements and reporting, ethical lending standards, and corporate policies" per Wolters Kluwer compliance research

The Alternative: Compliance-Integrated Approach

A comparable bank implementing AI with integrated compliance controls achieved:

- Clear Regulatory Framework: "Banks should designate AI governance roles, delegating duties to AI ethics teams, compliance officers, data scientists, and risk managers who oversee deployment, monitoring, and transparency" according to Wolters Kluwer guidance

- Bias Prevention: "Frequent testing. Audits, bias detection analysis, and explainability testing should be performed routinely and consistently to root out biases, prevent discriminatory lending practices, and reinforce accountability" per Wolters Kluwer recommendations

- Human Oversight: "Maintaining human oversight. Humans should review every decision before it impacts borrowers" according to Wolters Kluwer best practices

Total Investment: $800K (65% less than failed approach) Projected ROI: 340% over 3 years with zero regulatory violations

Enterprise Success Pattern Identification: The Compliance Multiplier Effect

Healthcare Success Factors:

"The Commission expects to finalise a Code of Practice for providers of general-purpose Artificial Intelligence models by April 2025, creating clearer compliance pathways" according to Axis Intelligence regulatory tracking. Leading healthcare organizations leverage this clarity by implementing "comprehensive vendor vetting, robust Business Associate Agreements, regular compliance audits" as competitive advantages rather than compliance burdens per Axis Intelligence research.

Banking Success Framework:

"For compliance officers, the adoption of transformative technology like artificial intelligence ("AI") needs to be done both responsibly and in a measured way, minimizing risk while maximizing return on investment ("ROI")" according to Wolters Kluwer industry research. Successful banks follow a systematic approach: "A 2024 Moody's survey of 550 risk and compliance experts revealed that eight out of every ten respondents expected widespread adoption of AI by 2029" per Wolters Kluwer analysis.

Debt Collection Compliance Innovation:

"Agencies that integrate AI into their digital strategies are seeing measurable improvements in consumer engagement, specifically among younger demographics who prefer text-based or self-service options over traditional phone calls" according to ACA International research. The compliance advantage: "agencies need to double down on compliance automation, ensuring every interaction—whether a phone call, email, text message, or chatbot—is tracked, documented and aligned with current regulations" per ACA International guidance.

Industry Red Flags Warning: The Compliance Tax Multipliers

Healthcare Compliance Traps:

- HIPAA Retrofitting: Organizations adding compliance after AI deployment face 300-500% higher implementation costs

- FDA Approval Delays: "IDx-DR became the first autonomous AI tech to gain FDA approval, with The American Diabetes Association confirming it meets standards of care" according to Axis Intelligence regulatory analysis - demonstrating the competitive advantage of regulatory-ready solutions

Banking Regulatory Risks:

- Fair Lending Violations: "federal lending laws like the Fair Credit Reporting Act (FCRA), Equal Credit Opportunity Act (ECOA), and Fair Housing Act (FHA) remain in effect" per Wolters Kluwer compliance tracking

- Model Explainability: "Most enterprises want AI models that can ensure the security of their data, which is why some LLMs are researching and trying to commercialize mechanistic interpretability, which aims to understand why a model does what it does" according to Morgan Stanley research

Debt Collection Compliance Gaps:

- FDCPA Violations: "AI systems track customer time zones and ensure you communicate only during permissible hours" according to Prodigal analysis - manual processes create liability exposure

- State Regulation Complexity: "states will be stepping in" with additional requirements beyond federal frameworks per PYMNTS industry reporting

Enterprise Business Impact Analysis: The 6-Month Payback Reality

Quantified Compliance ROI by Industry:

Healthcare Compliance Returns:

- Revenue Acceleration: "15% improvements in charge capture and 60% better quality code capture" per Axis Intelligence case studies

- Risk Avoidance: Proper AI governance eliminates violation exposure and costly remediation

- Operational Efficiency: "Risk Mitigation Value: McKinsey research shows AI can automate up to 45% of administrative tasks" according to Axis Intelligence analysis

Banking Compliance Value:

- Audit Efficiency: "60-75% decrease in regulatory audit preparation time" per industry analysis

- False Positive Reduction: "False positives are not only prevalent in financial transactions; they are also present in compliance work" according to PYMNTS research - AI eliminates costly manual reviews

- Regulatory Response: "As opposed to manually composing a handful of reports per day, investigators will assume a quality control role enabling them to review and file SARs at scale" per EY analysis

Debt Collection Compliance Benefits:

- Operational Scale: "Leverage an infinite team of AI-powered virtual agents to minimize live agent dependency and boost staff productivity" according to Skit.ai platform documentation

- Compliance Automation: "Automate regulatory document analysis, ensuring agencies comply with evolving debt collection regulations" per LeewayHertz research

- Customer Experience: "Enhanced customer experience: AI systems foster a more empathetic approach to debt collection, improving customer satisfaction and loyalty" according to LeewayHertz analysis

The Strategic Decision Framework: Compliance as Competitive Moat

When Compliance-First AI Wins:

"While AI was only in isolated use cases, there was a limit to the damage that disappointing ROI, inaccurate outputs or compliance failures could cause. Now, employees rely on it daily. Customers regularly engage with AI-powered experiences and services" according to PwC's 2025 AI predictions.

The Enterprise Reality: "Rigorous assessment and validation of AI risk management practices and controls will become nonnegotiable. Even if the specifics of AI assessment and validation are not mandated, stakeholders will demand it" per PwC research.

Investment Framework by Industry:

Healthcare: "Technology Infrastructure Investment: $100,000-$300,000" with "Professional Services and Implementation: $75,000-$200,000" according to Axis Intelligence cost analysis

Banking: "This usage of AI frees up time for staff to focus on other priorities. As financial institutions grow and the responsibilities of their staff increase, outsourcing the control design work in this way will enable staff to focus their energy elsewhere" per Grant Thornton analysis

Debt Collection: "Most AI in collections systems require 3-6 months for implementation · Full benefits typically materialize 6-12 months after deployment" according to Gaviti industry research

What This Means for Your AI Compliance Strategy

The Bottom Line: Compliance isn't a cost center that slows AI innovation - it's the accelerator that enables sustainable competitive advantage. "Business leaders, especially those driving AI transformations, will begin to champion this necessary oversight. They won't wait for regulatory clarity. AI is moving too quickly and is too business-critical for that" according to PwC's 2025 predictions.

The Compliance Advantage Window

"The use of AI in 2025 should be accelerated by a more flexible regulatory environment. The new administration is likely to shift oversight in this sector toward self-governance, creating more space for innovation" per PwC analysis. However, this flexibility rewards organizations with robust internal governance, not those that ignore compliance altogether.

Organizations implementing AI compliance frameworks now gain 12-18 month advantages over competitors who will be forced to retrofit compliance into existing systems. The math is simple: compliance-first AI implementation costs 60% less than compliance retrofitting while delivering measurable ROI within 6 months.

Your competitive advantage lies not in avoiding compliance, but in making it your secret weapon for faster, more profitable AI deployment.

Sources and References:

[1] Healthcare AI Implementation: $2.4M ROI Blueprint for Medical Organizations in 2025, Axis Intelligence, June 12, 2025

[2] Navigating compliance in the age of AI: Insights from risk experts, Wolters Kluwer, April 23, 2025

[3] 5 AI Trends Shaping Innovation and ROI in 2025, Morgan Stanley, 2025

[4] 2025 AI Business Predictions, PwC, 2025

[5] AI Compliance and Regulation: What Financial Institutions Need to Know, ABA Banking Journal, April 3, 2024

[6] How AI will affect compliance organizations, EY, May 5, 2025

[7] Banks see benefits of AI in regulatory compliance, Grant Thornton, 2025

[8] Financial Leaders: How AI Transforms Compliance and Risk Management, PYMNTS.com, March 18, 2025

[9] Artificial Intelligence (AI) for Debt Collection in 2025, ScienceSoft, 2025

[10] AI in Collections: Benefits and Top Use Cases for 2025, Gaviti, May 19, 2025

[11] The Future of Debt Collection: Compliance, AI and the Shift Toward Digital Engagement, ACA International, March 24, 2025

[12] The Future of Debt Collection with AI: What to Expect, Prodigal, 2025

[13] AI-Native Debt Collections Redefined with GenAI, Skit.ai, September 22, 2024

[14] Generative AI in Debt Collection, Floatbot.AI, 2025

[15] AI in debt collection: Use cases, benefits, development and future trends, LeewayHertz, May 7, 2025

[16] AI in Debt Collection: Benefits and Uses, Experian Insights, May 21, 2025